The purchase requisition must get approved before forwarding it to the purchasing department. Analysis – If there are no further transactions, the Ledger account is balanced and shows security check a debit balance. Analysis – PepsiCo will go through each transaction and transfer the account information into the debit or credit side of that ledger account being affected.

Step #4: Prepare an unadjusted trial balance

As an accounting student or professional, you must be well aware of the complete accounting cycle. It is a complete process where an accountant or the bookkeeper performs accounting tasks. A journal is a book – paper or electronic – wherein transactions are recorded. Also, this step would involve the preparation or collection of business documents, or as auditors would call them – source documents. A business document (such as sales invoice, official receipt, etc.) provides evidence that a particular transaction happened, and serves as basis in recording the transaction.

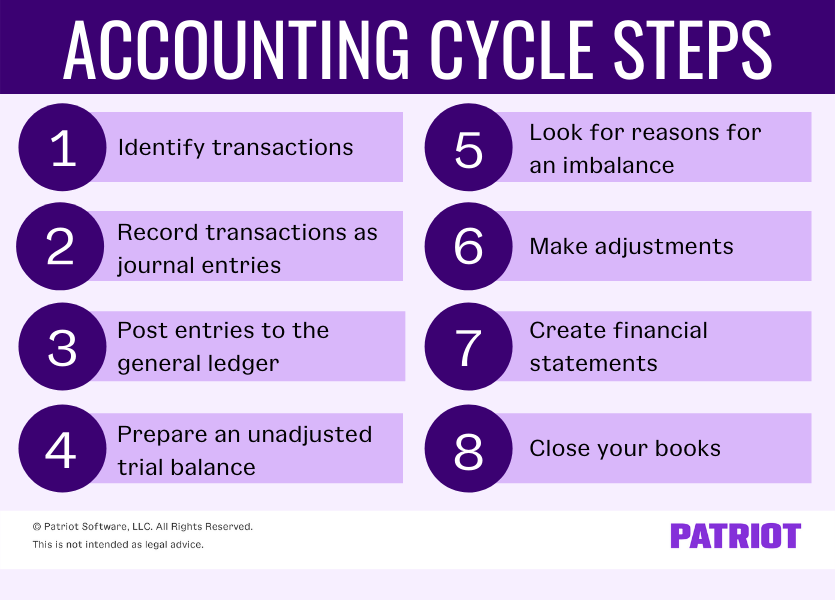

The Accounting Cycle: 8 Steps You Need To Know

Not following the accounting cycle would likely lead to an accumulation of bookkeeping errors, which could cause severe problems for your business. The total credit and debit balance should be equal—if they don’t match, there’s an error somewhere. The unadjusted trial balance is the initial version of the trial balance that hasn’t been analyzed for accuracy and adjusted as needed. The general ledger is a central database that stores the complete record of your accounts and all transactions recorded in those accounts. You need to identify all transactions that occur throughout the fiscal year. The best approach to do that is to create a system where every transaction is automatically captured because that prevents human error.

- For example, all entries relating to sales are recorded in the sales account.

- As an accounting student or professional, you must be well aware of the complete accounting cycle.

- She is a former CFO for fast-growing tech companies with Deloitte audit experience.

- Because Ray uses software that automates his financial workflows, these transactions automatically sync into his accounting software.

- A cash flow statement shows how cash is entering and leaving your business.

The importance of double-entry bookkeeping

The main purpose of drafting an unadjusted trial balance is to check the mathematical accuracy of debit and credit entries recorded under previous steps. Adjusting entries is necessary to update the account balances before financial statements are prepared. They ensure that revenues and expenses are recognized in the period they occur. Adjustments could include accrued expenses, prepaid expenses, depreciation, and revenue recognition adjustments. Once the company has adjusted all the entries as necessary, you can create financial statements. Most businesses generate balance sheets, income statements and cash flow statements.

Use of accounting software

Adjusting entries are prepared as an application of the accrual concept of accounting. At the end of the accounting period, some expenses may have been incurred but not yet recorded in the journals. Accountants first need to gather information about business transactions, then record and collate them to come up with values to be reported (steps 1-6 in the accounting cycle).

Company

Once the supplier collects the cheque at the finance department, they sign on a cheque register and provide receipts as evidence of payment. The finance department then stamps the documents with a ‘Paid’ designation to prevent duplicate payments before returning them to accounting for record-keeping. When a department in the company needs to purchase any item, they fill out a purchase requisition and specify the item’s type, price, and purpose of use. The purchase requisition needs to be approved by an authorized personnel before proceeding with the purchase to ensure that the item is truly beneficial and necessary for the company. A purchase order (PO) is an extension of a purchase requisition (PR). The purchase requisition is an internal company document used to inform the management or leaders that the company needs to purchase a certain thing such as raw materials or office equipment.

That accounting period might be a month, a quarter, or a fiscal or calendar year. Errors in bookkeeping can lead to significant financial discrepancies. Ensuring accuracy in recording and posting transactions is a constant challenge, especially in high-volume environments.

At the core of HighRadius’s R2R solution lies an AI-powered platform catering to diverse accounting roles. An outstanding feature is its ability to automate nearly 50% of manual repetitive tasks, achieved through a No Code platform, LiveCube. This innovative tool replaces Excel, automating data fetching, modeling, analysis, and journal entry proposals.

You need to calculate the trial balance at the end of the fiscal year. The objective of the trial balance is to help you catch mistakes in your accounting. That being said, accrual accounting offers a more accurate picture of the financial state of any given business, which is why in some cases, companies are obligated by law to use this method. Making two entries for each transaction means you can compare them later. All popular accounting apps are designed for double-entry accounting and automatically create credit and debit entries. However, you also need to capture expenses, which you can do by integrating your accounting software with your company’s bank account so that every payment will be charged automatically.