Since the chart of accounts creates a listing of all accounts as found within the general ledger, it contributes to the creation of the double-entry bookkeeping system as well. In other words, the chart of accounts lists all the information provided in the general ledger and then uses specific codes to denote the bookkeeping transactions. This makes it easier to find particular accounts across hundreds and thousands of them. It provides a bird’s eye view of what is happening within certain business functions or divisions based on account-specific information. It also provides an understanding of which products or services are providing the most revenue if you have organized the chart of accounts that way. Instead, a chart of accounts provides business owners (and other stakeholders) a bird’s eye view of the company’s day-to-day operations at a glance.

Would you prefer to work with a financial professional remotely or in-person?

If you’re using accounting software and want to set up a customized chart of accounts, you can add or edit parent and sub-accounts to the existing default chart of accounts. Doing this will help you stay organized and better understand how your business is doing financially. Having a Chart of Accounts allows businesses to easily track their financial transactions, generate meaningful financial reports, and maintain compliance with applicable regulations. It also ensures consistency in the way expenses are reported and simplifies bookkeeping tasks.

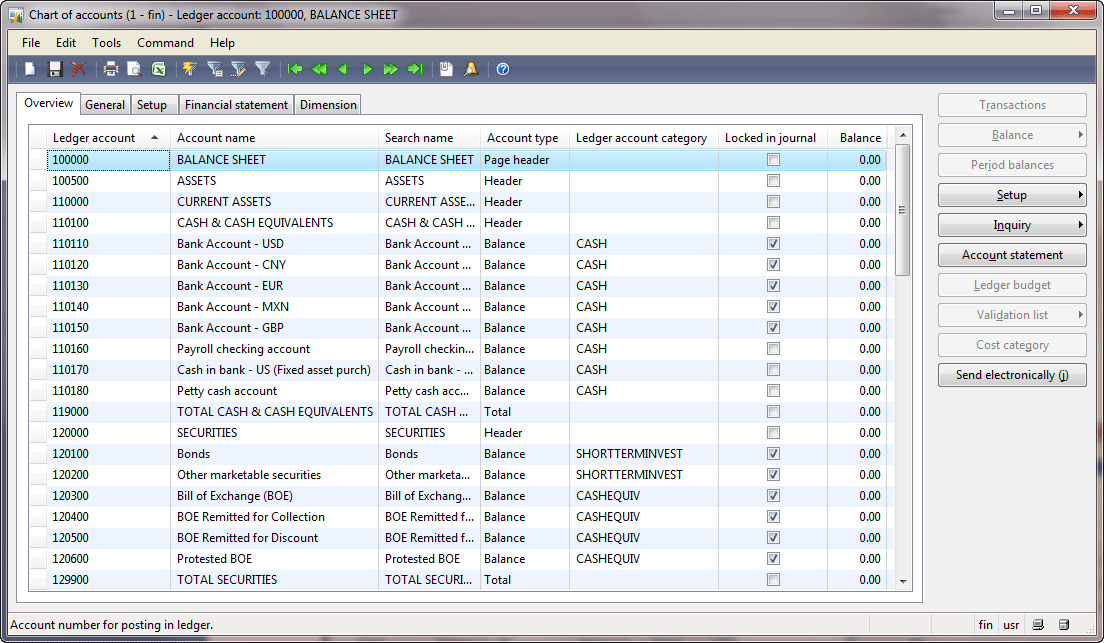

Example: Standard Chart of Accounts List

- More complex entities may have longer account codes to accommodate the reporting needs of the entity.

- In the interest of not messing up your books, it’s best to wait until the end of the year to delete old accounts.

- For example, bank fees and rent expenses might be account names you use.

- In conclusion, integrating your Chart of Accounts with accounting software like QuickBooks Online significantly improves the efficiency and accuracy of financial management.

Businesses may add, remove, or modify accounts to better track their financial transactions, manage costs, and analyze performance. Customization ensures that a chart of accounts accurately reflects the unique activities and financial structure of a business. This provides an insight into all the financial transactions of the company. Here, an account is a unique record for each type of asset, liability, equity, revenue and expense. A chart of accounts compatible with IFRS and US GAAP includes balance sheet (assets, liabilities and equity) and the profit and loss (revenue, expenses, gains and losses) classifications.

How can a chart of accounts be customized for different businesses?

Even for a small business, however, more digits allow the flexibility to add new accounts as the business grows in the future, while maintaining the logical order of the coding system. Changes – It’s inevitable that you will need to add accounts to your chart in the future, but don’t drastically change the numbering structure and total number of accounts in the future. A big change will make it difficult to compare accounting record between these years.

By incorporating these advanced COA concepts, an organization can streamline its financial management processes and optimize its performance while remaining compliant with regulatory and industry standards. Sales returns are amounts refunded to customers or deducted from the total income due to product returns, discounts, or cancellations. Second, let’s see how the journal entries feed into the general ledger which feeds into the trial balance.

In addition to the universal general accounts that are prevalent in most entities, each entity will include certain accounts that are particular to its industry sector. Instead, each entity has the flexibility to customize its accounts chart to fit the specific individual needs of the business. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching. After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

No, a chart of accounts is not required for businesses… but it is necessary if you want to keep your transactions organized and categorized in a way that’s easily accessible when you need them. You’ll also want to use the same format each accounting cycle, so when it comes time to compare your data, you’re comparing apples to apples.Accounting software, like Wave’s, can help with that. Not only will it keep things consistent, but it helps you with the heavy-lifting.

Retained earnings can positively impact the company’s financial stability and growth prospects. As I close, let me encourage you to give your chart of account decisions plenty of thought. If you don’t give your chart of accounts the early love it deserves, you may regret it. Creating a new accounting systems six years out, for example, would be a major headache. First, let’s look at how the chart of accounts and journal entries work together. Below, I explain what a chart of accounts is and how you will use it in bookkeeping and accounting.

Business needs and regulations change over time, so it’s important to review your COA periodically to ensure it continues to meet your business requirements. This might involve adding new accounts, removing redundant ones, or restructuring sections to improve clarity and functionality. Maintain consistency in how transactions are recorded and categorized.

A well-designed chart of accounts should separate out all the company’s most important accounts, and make it easy to figure out which transactions get recorded in which account. They represent what’s left of the business after you subtract the definitive guide to recruiting for accounting firms all your company’s liabilities from its assets. They basically measure how valuable the company is to its owner or shareholders. Consider creating separate line items in your chart of accounts for different types of income.