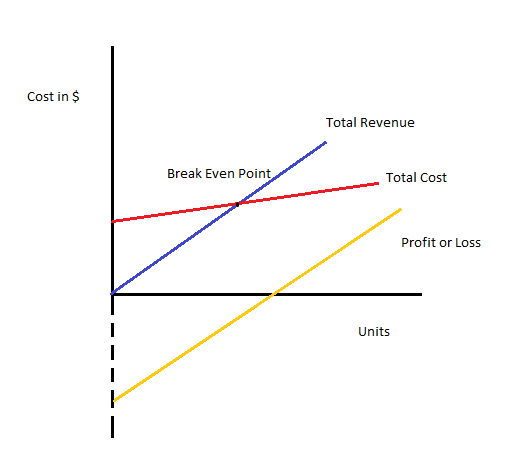

Sales below the break-even point mean a loss, while any sales made above the break-even point lead to profits. It is possible to calculate the break-even point for an entire organization or for the specific projects, initiatives, or activities that an organization undertakes. Input your data and get instant results for informed financial decision-making. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

Great! The Financial Professional Will Get Back To You Soon.

If you are looking to make and investment or startup your own business, it is important to know your break even point first. Start ups are exciting, but demand a lot of planning, attention and consistent effort. At the same time, it is essential too think realistically when starting up a new venture.

Accounting Calculators

Therefore, ABC Ltd has to manufacture and sell 100,000 widgets in order to cover its total expense, which consists of both fixed and variable costs. At this level of sales, ABC Ltd will not make any profit but will just break even. First we take the desired dollar amount of profit and divide it by the contribution margin per unit. The computes the number of units we need to sell in order to produce the profit without taking in consideration the fixed costs. However, it might be too complicated to do the calculation, so you can spare yourself some time and effort by using this Break-even Calculator. All you need to do is provide information about your fixed costs, and your cost and revenue per unit.

Can this calculator help me optimize my pricing and cost strategies?

Let’s take a look at a few of them as well as an example of how to calculate break-even point. Break-Even Analysis is a financial calculation that helps businesses determine the number of units they need to sell to cover their costs. It helps businesses understand the point at which they will start making a profit.

That means that the more people want things, the higher the demand. The less availability, the easier it is to increase the relative value of a product. This is why big companies like apple release their new iPhone in a controlled manner.

Do you already work with a financial advisor?

It’s one of the biggest questions you need to answer when you’re starting a business. Use our simple Break-Even Analysis calculator to determine the number of units you need to sell to cover your costs. Just enter your fixed costs, variable costs per unit, and sale price per unit. Fixed costs are costs that do not change based on your production or sales volume (e.g., rent, insurance, and salaries). Variable costs are costs that fluctuate depending on how much you produce (e.g., raw materials, labor per unit).

Our break-even calculator is a useful tool to refer to when determining prices for the goods and services you offer, deciding on budgets or simply working on a business plan. The latter is a similar calculation, but it’s based around knowing how much you bring in over a certain period of time. It might be a good idea to come back to this break-even calculator after you actually start doing business. Often times you will find the need to adjust your costs and factor in things you overlooked before. The break-even point is the number of units that you must sell in order to make a profit of zero.

- The federal residential clean energy credit, for example, gives you up to 30% back.

- Excel’s versatility and ability to handle complex calculations make it a popular choice for businesses of all sizes, and templates for break-even analysis are widely available.

- This means you need to sell approximately 769 units to cover your costs.

- All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

Quantifying those components correctly allows you to identify areas where you may be able to cut costs. On the basis of values entered by you, the calculator will provide you with the number of units you would require to reach a break-even point. Our online calculators, converters, randomizers, and content are provided “as is”, free of charge, and without any warranty or guarantee.

A business would not use break-even analysis to measure its repayment of debt or how long that repayment will take. There are a lot of different ways to pay for solar panels, and they all educator expense deduction affect the solar payback period. Sometimes rooftop solar can completely cover your electricity needs — reducing your utility bill to $0 — and sometimes it only covers a portion of it.