Content

The organization sends your own payment since the either a, wire import, otherwise ACH lender import. We’ve got along with leftover tabs on any will set you back involved with the brand new finest mobile fee applications. Earliest informal deals only require one to features an easy-but-energetic application, in case you are interested in much more features, the brand new paid-to have choices will be well worth a look. We’ve appeared the significance for cash facet of people integrated here.

Shell out Your own Debts with Crypto

That’s why you ought to disable history investigation have fun with by visiting the brand new settings on your own mobile phone and you will shutting off the background research usage for each and every application. Even if signing up for automated fee or paperless charging you acquired’t save a lot of money, it’s still one useful strategy to lessen your own mobile costs. Thus, make sure to choose paperless billing or automobile-pay right now. Bettors whom’ve sort through the new sections appeared in this post will get offered themselves a good feet-abreast of its travel to betting thru cellular phone expenses.

Better playing cards to spend costs and you can secure rewards

That have Hiatus, all monetary commitments come in you to set, to more easily control your using as well as create particular changes to get your on the road on the financial victory. Asking if In the&T often match an opponent’s rate can seem risky. Although not, customer care agencies try urged to store users that looking someplace else to have a lower price. They may be far more happy to assist you if you stand, even if it wear’t satisfy the rival’s rates. Nothing folks want to sit on the telephone for hours on end, if not 30 minutes at this. But sometimes one to’s what is needed discover that much a lot more of your From the&T features.

- When you deduct the cash straight back from the overall number paid off ($103 – $step 1.55), you’ve indeed invested $101.forty five to the a great $100.00 domestic bill.

- Bank put profile, including examining and you can deals, can be susceptible to acceptance.

- Of numerous United kingdom gambling enterprises undertake PayPal as the both a deposit and you can a detachment.

As with any most other purchase, you can secure perks on the month-to-month mobile costs by using a great perks credit card https://vogueplay.com/au/roulette/ to cover your own expenses. Once you know which card to make use of, you can buy around 5% right back on your smartphone expenses every month, and the ones rewards can add up over the years. With respect to the sportsbook which you choice that have and the cell phone bill payment service you use, you’ll constantly become gambling through an encrypted and you may really-secure system.

Start the newest application and you may tap Put a payment way of include a different cards for your requirements, then stick to the tips. For those who have several notes, tap Build standard lower than any of them to create usually the one that is going to be first-in the newest queue and if you might be investing for some thing. With Chase to have Organization you’ll discover guidance out of a group of team experts who specialise in helping boost earnings, taking borrowing alternatives, and you will handling payroll. Pick from organization checking, organization handmade cards, merchant features or see our very own organization money center.

Bundling the expense of telephone service can in fact help save you slightly a little while finally, especially if you have a big family members. You’ll find various money-protecting applications that will help you save money around the each of your expenditures, not only your own cellular telephone costs. Find one that is correct to you personally and have been rescuing, well known one is Skyrocket Money. Saving cash starts with looking at just what functions you’re subscribed to and you will exactly what rates you’re already using.

Considering the fact that 31% of the FICO credit score relies on which proportion, it’s better to keep membership balance as little as it is possible to. Digital money give advantages, specifically if you’lso are a smart and in charge charge card associate. For many who’d need to choose a credit card to pay their book, home loan, or any other bills, end up being strategic in the which credit make use of. A large then expenses, for example, would be a convenient costs so you can earn a premier-value signal-right up bonus. Yes, you can use a credit card to spend bills, but you will find dangers you must know on the.

Race along with other providers try strong, so they may indeed agree! A good QR password usually unlock the cashier can be procedure as the a credit, and you may test. For those who don’t get access to the fresh My Verizon app (or if you only dislike typing some thing on your own tiny cell phone screen with your wider fingertips, like me) you can utilize Verizon’s website to shell out your expenses.

Protecting additional money every month is achievable, sufficient reason for these types of 14 suggests, you’lso are sure to set a few more cash back in the bag. There are many experience you can learn if you are helping During the&T, for example support service, selling, and you will technical service. If it’s work your performs when you are gonna college or simply something you invest in to get those offers, doing work for From the&T could be more rewarding than do you consider. Among the most difficult actions you can take nowadays are keep tabs on where your money is certian.

- Choose one that is true to you personally and have started protecting, well known one is Rocket Money.

- Make it possible for which for the children, establish children Discussing Group via Apple otherwise Family members Hook inside Google.

- Moreover it also provides a sophisticated away from defense by using multi-step authentication methods to safeguard their purchases.

- They are able to give you advice about what is the next best step to experience the money you owe and possess a manage on your money.

- If you wish to play with investigation when you are take a trip beyond European countries, the purchase price may vary considerably according to the vendor.

- On line expenses spend features, usually given by financial institutions, will let you agenda money straight from your account.

However, that isn’t really the only need to pay their bill which have credit cards. Naturally, the fresh perks earned in your monthly mobile aren’t probably going to be adequate to entirely counterbalance the cost of an annual percentage to the a cards. You should know having fun with a card that can as well as secure rewards to your most other get kinds you appear to invest within the. You will not get “issues rich” by simply using your own monthly smartphone statement which have credit cards. But it’s however important to make use of the correct cards to pay for one to month-to-month expenses.

The only real cities the brand new MST function won’t work is everywhere you need to enter the credit, for example an automatic teller machine machine, otherwise a gas push. To get going having Apple Spend, open the fresh Purse app which comes pre-installed on their iphone 3gs and range from the notes you want to utilize. You’ll also have to range from the shelter code, found on the straight back of each and every cards. The fresh Handbag app usually speak to your financial to confirm the newest credit, and after that you’re also working. Wearable inventor Fitbit has already established its Fitbit Pay program as the 2017—and certainly will continue doing therefore at the least up until Bing performs away just what it is going to do inside. Just as in Apple Shell out and you may Google Pay, you can use Samsung Shell out on your own Galaxy mobile phone or observe everywhere you find the fresh contactless percentage indication, thru NFC.

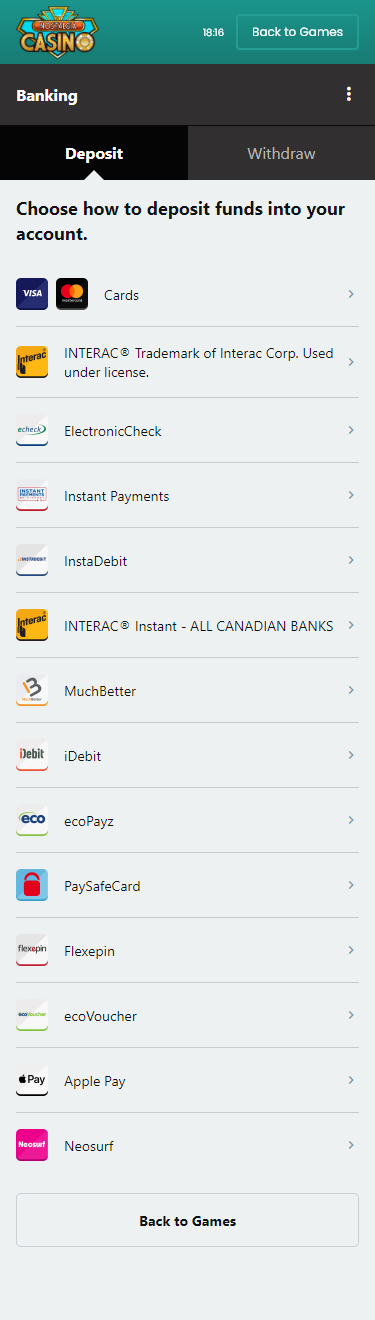

The brand new sales may include additional cellular investigation, services rewards, or a share out of your payment. Ask your network company when they give one bonuses to own signing up inside the automatic costs. But either the conclusion the new day happens reduced than expected as well as the balance on the checking account may not be enough to cover their costs. In the event the day are of your own substance, it may be you can to pay a statement from the offers account—but there are some factors it isn’t necessary. That have an android tool, very first, wade the fresh “Settings”, then “Connections” then trigger “NFC and you may contactless money”. See “Unknown credit”, “Next”, and “Accept” the newest Terms of service.